Simplify Your Fiscal Compliance

Test free with Training invoices or sandbox smart cards

No payment info needed

9k

Happy Customers

Thousands of satisfied businesses confidently managing fiscal compliance with ease.

3.21m

Invoices Processed

Over half a million invoices seamlessly signed and securely reported.

4.87/5

Customer Rating

Highly rated by businesses for reliability, ease of use, and exceptional support.

Everything in One Place

Manage, monitor, and report all your fiscal data effortlessly through a single, streamlined solution.

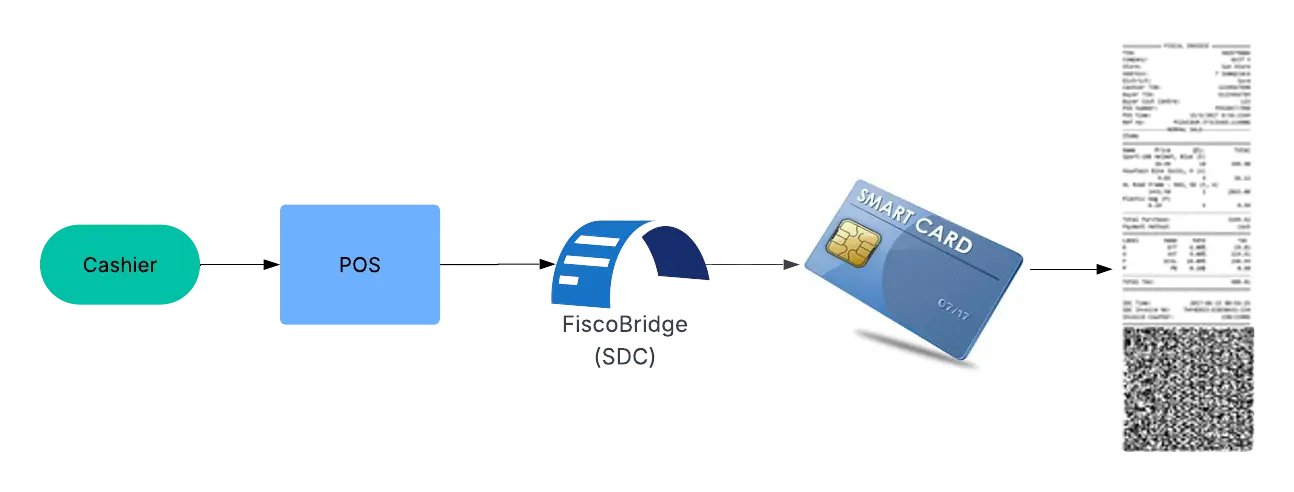

Centralized Fiscal Processing

FiscoBridge acts as your all-in-one Sales Data Controller (SDC), securely receiving and analyzing transaction data from your POS. It formats that data into official fiscal invoices, digitally signs them, and sends them back to your POS for printing—ensuring every transaction is properly documented and compliant.

Secure Transmission & Storage

Beyond invoice generation, FiscoBridge preserves all transaction and fiscal data in a secure, tamper-proof format. It communicates with the Secure Element, POS, and Tax Authority systems to transmit audit data and maintain real-time compliance with local fiscal regulations.

The Complete SDC Solutions

Everything you need for seamless fiscal management and compliance

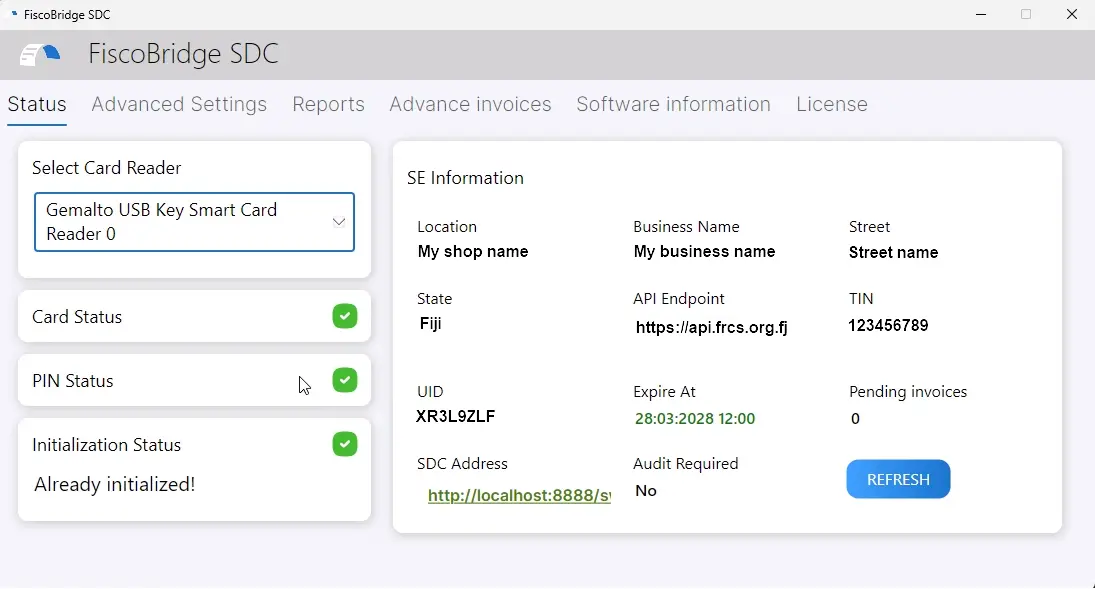

Intuitive User Interface

A clean, simple, and user-friendly interface, designed to streamline your fiscal tasks effortlessly.

Comprehensive Reporting

Gain valuable insights with daily, weekly, and monthly reports to enhance your fiscal decision-making.

Seamless Integration

Integrate smoothly with your existing POS system—no additional hardware, no complex setups.

Reliable and Secure SDC

Trusted software ensuring complete fiscal compliance, protecting your data with advanced encryption and secure transaction management.

User-Friendly Interface

Easily navigate and control your fiscal tasks through an intuitive dashboard designed for businesses of all sizes.

Enhanced Efficiency

Automate your fiscal compliance process to boost productivity, reduce errors, and free up valuable resources.

Secure Data Handling

Ensure every transaction is securely transferred, signed, and stored, keeping your fiscal data confidential and compliant.

Real-Time Compliance

Access up-to-the-minute fiscal data and ensure continuous compliance with local tax regulations.

Real-Time Daily Reports

Effortlessly generate comprehensive daily fiscal reports that provide immediate insights into your business's financial health, compliance status, and transactional accuracy—setting a new standard in fiscal management.

Unmatched Accuracy & Insight

Leverage the market-leading daily reporting feature to confidently manage your operations, ensuring precise fiscal compliance and giving you a clear picture of your day-to-day performance.

Our Happy Customers

Real stories from real people who love our service

Since implementing FiscoBridge, we've saved countless hours and reduced compliance errors to zero. It's incredibly reliable and user-friendly. I highly recommend it for any business needing robust fiscal management.

Choosing MetricMaster’s FiscoBridge was the best decision we made this year. The software works flawlessly, and their support team has been exceptionally responsive and helpful whenever needed.

MetricMaster didn't just help us develop our own SDC—they became trusted partners throughout the entire project. Their expertise enabled us to deliver a high-quality solution quickly and confidently to our customers.

FiscoBridge has transformed how we handle fiscal compliance at our store. Everything runs smoothly, receipts are accurate, and reporting is effortless. It’s been a real game changer for our business!

Questions & Answers

Everything you need to know, answered clearly

1. What exactly is FiscoBridge and how does it help my business?

FiscoBridge is a software-based Sales Data Controller (SDC) that automatically tracks, signs, and reports all your sales transactions to ensure complete fiscal compliance. It helps your business run smoothly without worrying about complex tax reporting procedures.

2. Can FiscoBridge integrate with my existing POS system?

Absolutely! FiscoBridge is designed to seamlessly integrate with virtually any POS system supporting web service requests, allowing effortless implementation without requiring additional hardware.

3. Do you provide daily, weekly, and monthly reports?

Yes, our Pro package offers advanced daily, weekly, and monthly reporting features. These detailed reports provide valuable insights and simplify your fiscal management, setting us apart from other solutions on the market.

4. Is FiscoBridge fully accredited by local Tax Authorities?

Yes, FiscoBridge is fully accredited, licensed, and compliant with all tax authorities in the supported Pacific markets.

5. Do I need a continuous internet connection to use FiscoBridge?

No, FiscoBridge operates efficiently even offline, securely storing your transactions until the connection is restored. It then automatically synchronizes and reports your data, ensuring you remain compliant at all times.

6. How easy is it to install and get started with FiscoBridge?

Installation is straightforward, and our user-friendly setup process requires minimal technical knowledge. You can quickly install FiscoBridge on Windows, Linux, or Mac, and our support team is always available to guide you through every step.

Have any questions? Get in Touch